Partner Us

Partner Us

Benefits

roongtasecurities.com is an online platform (available on mobile app and web), which enables paperless transactions for all mutual funds available in India.

roongtasecurities.com operates through distributors who can expand their business with the help of the platform.

Distributors already dealing in mutual funds can expand their client base and reach with the help of roongtasecurities.com.

Distributors dealing in other financial products like insurance or retired bank managers and chartered accountants can start distributing mutual funds with zero investment.

Here are the benefits to the distributors:

- Paperless Transactions: Mobile App / Web Platform for transacting in few clicks. All transactions available. Save costs in filling up and deposit of physical application forms. Distributors can execute transactions for their clients. Extremely easy to set-up Switch and Systematic Transfer Plan.

- Portfolio Reports: Distributors can access all client reports. Similarly, client can also log-in and track their own portfolio. This helps in reducing client servicing cost for distributors and enhances client satisfaction!

- Easy Scheme Selection: roongtasecurities.com provides researched schemes under pre-defined buckets linked to investment objectives like Build Wealth, Save Taxes, Regular Income Plan, which makes it easy to select right mutual funds schemes.

- All Fund Houses Available: roongtasecurities.com is a fund neutral platform and provides all mutual funds schemes in the platform, so you can transact in boutique funds like MotilalOswal, Quantum, Edelweiss, etc. as well.

- Content Marketing: Constant flow of relevant articles for increased investor awareness and knowledge.

- Periodic alerts and Notifications: Upcoming SIPs, SIP bounces, Business Dashboard, etc.

Eligibility Criteria

roongtasecurities.com is an ideal platform for any-one to start mutual funds distribution business. Persons engaged in following businesses will find it easier to get started:

- Chartered accountants

- Cost accountants

- Investment advisors

- Direct selling agents for loan products

- Postal / chit-fund agents

- Persons currently working in financial services companies looking to start at their own

- Stock-brokers

- Retired bank managers

- Retired defence personnel

- Retired (Other)

- Homemaker

- Students

- Insurance agents

- Veer Naari's (War Widows)

All persons involved in selling of mutual fund schemes are required to obtain AMFI Registration Number (ARN) (more details here https://www.amfiindia.com/distributor-corner/become-mutual-fund-distributor).

We help you in the process of obtaining ARN.

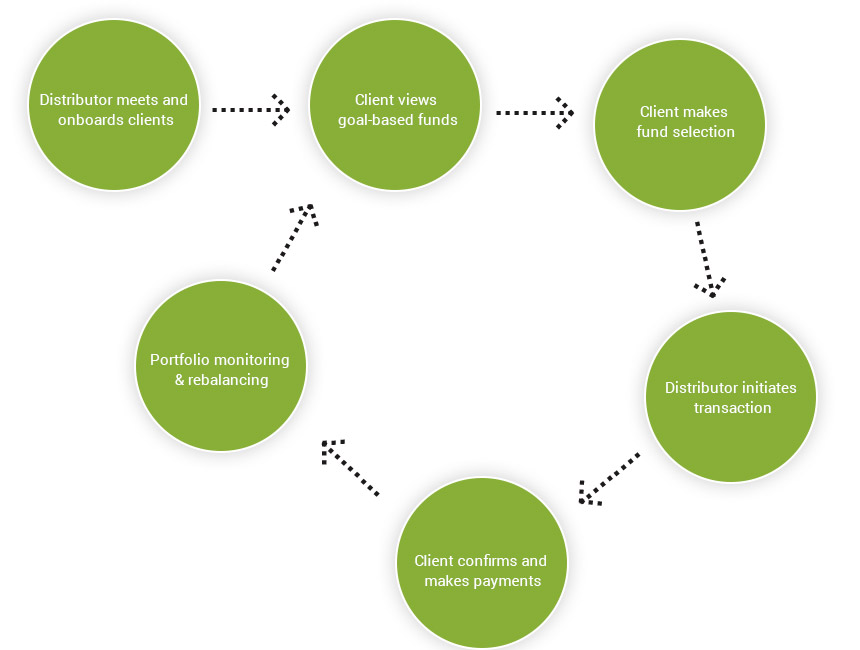

How It Works